FCA Regulatory Disclosure on the Stewardship Code

Under Rule 2.2.3R of the Financial Conduct Authority (“FCA”) Conduct of Business Sourcebook (“COBS”), the FCA require authorised firms such as Infinity Investment Partners Limited to disclose the nature of its commitment to the FRC’s UK Stewardship Code or, where it does not commit to the Code, its alternative investment strategy.

The Code aims at enhancing the quality of engagement between institutional investors and companies. It seeks to set out good practices on engagement with investee companies, resulting in improved long-term returns to shareholders and efficient exercise of governance responsibilities.

The Financial Reporting Council’s (“FRC”) defines ‘stewardship’ as ‘the responsible allocation, management and oversight of capital to create long-term value for clients and beneficiaries leading to sustainable benefits for the economy, the environment and society.’

The 2020 Code Principles are:

- Signatories’ purpose, investment beliefs, strategy, and culture enable stewardship that creates long-term value for clients and beneficiaries, leading to sustainable benefits for the economy, the environment and society.

- Signatories’ governance, resources and incentives support stewardship.

- Signatories manage conflicts of interest to put the best interests of clients and beneficiaries first.

- Signatories identify and respond to market-wide and systemic risks to promote a well-functioning financial system.

- Signatories review their policies, assure their processes and assess the effectiveness of their activities.

- Signatories consider client and beneficiary needs and communicate their stewardship and investment activities and outcomes to them.

- Signatories systematically integrate stewardship and investment to fulfil their responsibilities, including material environmental, social and governance issues and climate change.

- Signatories monitor and hold to account managers, and-or service providers.

- Signatories engage with issuers to maintain or enhance the value of assets.

- Signatories, where necessary, participate in collaborative engagement to influence issuers.

- Signatories, where necessary, escalate stewardship activities to influence issuers.

- Signatories actively exercise their rights and responsibilities.

Purpose and governance

Investment approach

Engagement

Exercising rights and responsibilities

The adherence to the Code is voluntary, and Infinity Investment Partners Limited generally supports the objectives that underlie the Code. However, the Firm adopts an alternative strategy to stewardship by reviewing this approach on a case by case basis and considering the best way of optimising returns on each investment.

- Companies whose actions promote ESG criteria have been shown over time to generate extra returns for their investors;

- ESG factors directly influence a company’s lifetime cost of capital and hence its valuation.

The Firm believes that any investment analysis cannot exclude ESG principles for a variety of reasons:

The combination of the two above factors leads to an ever-increasing amount of institutional capital following such criteria. Thus, the first derivative is that most companies with ESG-positive profiles will benefit from the growing level of institutional coverage.

Should anything change in the future where the Firm deems it’s more relevant to committing to the Code, the Firm will update this disclosure accordingly.

For further details on any of the above information, please contact compliance at compliance@ infinityinvestmentpartners.com

Pillar 3 Disclosures

The Capital Requirements Directive (“CRD”) and the Alternative Investment Fund Management Directive (“AIFMD”) of the European Union (“EU”), both onshored into United Kingdom (“UK”) law by virtue of the European Union (Withdrawal) Act 2018 (“EUWA”), established a revised regulatory capital framework across the EU governing the amount and nature of capital credit institutions and investment firms must maintain.

In the United Kingdom, the CRD and AIFMD were implemented by the Financial Conduct Authority (“FCA”) in its regulations through the General Prudential Sourcebook (“GENPRU”), the Prudential Sourcebook for Banks, Building Societies and Investment Firms (“BIPRU”), the Interim Prudential Sourcebook for Investment Business (“IPRU (INV)”).

- Pillar 1 sets out the minimum capital amount that meets the Firm’s credit, market and operational risk capital requirement;

- Pillar 2 requires the Firm to assess whether its capital reserves, processes, strategies and systems are adequate to meet pillar 1 requirements and further determine whether it should apply additional capital , processes, strategies or systems to cover any other risks that it may be exposed to; and

- Pillar 3 requires disclosure of specified information about the underlying risk management controls and capital position to encourage market discipline.

The CRD consists of three ‘Pillars’:

The AIFMD adds further capital requirements based on the Alternative Investment Fund (“AIF”) assets under management and professional liability risks.

The rules in BIPRU 11 set out the provision for Pillar 3 disclosure. This document is designed to meet our Pillar 3 obligations.

The Pillar 3 disclosure document has been prepared by IIP in accordance with the requirements of BIPRU 11 and is verified by the board. Unless otherwise stated, all figures are as at the 31 December 2021 financial year-end.

Pillar 3 disclosures will be issued on an annual basis after the year-end and published as soon as practical when the audited annual accounts are finalised.

IIP is permitted to omit required disclosures if it believes that the information is immaterial such that omission would be unlikely to change or influence the decision of a reader relying on that information for the purpose of making economic decisions about the Firm.

In addition, IIP may omit required disclosures where it believes that the information is regarded as proprietary or confidential. In its view, proprietary information is that which, if it were shared, would undermine its competitive position. Information is considered to be confidential where there are obligations binding the Firm to confidentiality with its customers, suppliers and counterparties.

The Firm has omitted certain data on the grounds of materiality.

Scope and application of the requirements

IIP is authorised and regulated by the FCA and as such is subject to minimum regulatory capital requirements. The Firm is categorised as a Collective Portfolio Management Investment Firm (‘CPMI’) Firm’ by the FCA for capital purposes.

IIP is not a member of a group and so is not required to prepare consolidated reporting for prudential purposes.

Risk management

IIP has established a risk management process in order to ensure that it has effective systems and controls in place to identify, monitor and manage risks arising in the business. The risk management process is overseen by a dedicated risk manager, with the Senior Management team taking overall responsibility for this process and the fundamental risk appetite of the firm. Compliance has responsibility for the implementation and enforcement of the Firm’s risk principles

Senior Management meets on a regular basis and discuss current projections for profitability, cash flow, regulatory capital management, business planning and risk management. Senior Management engages in IIP’s risks through a framework of policy and procedures having regard to the relevant laws, standards, principles and rules (including FCA principles and rules) with the aim to operate a defined and transparent risk management framework. These policies and procedures are updated as required.

The Senior Management team has identified that business, operational and market are the main areas of risk to which the Firm is exposed. Annually the Senior Management team formally review their risks, controls and other risk mitigation arrangements and assess their effectiveness.

Updates on operational matters are provided to Senior Management on a regular basis. Management accounts demonstrate continued adequacy of IIP’s regulatory capital are reviewed on a regular basis.

Appropriate action is taken where risks are identified that fall outside of the Firm’s tolerance levels or where the need for remedial action is required in respect of identified weaknesses in IIP’s mitigating controls.

Business Risks

Specific risks applicable to the Firm come under the headings of business, operational, credit and market risks.

- The use of lock-up periods imposed by the funds; and

- Significant levels of capital held by the Firm which will continue to cover all the expenses of the business.

Business risk

IIP’s revenue is reliant on the performance of the existing funds under management. As such, the risk posed to the Firm relates to underperformance and ultimately the risk of redemptions from the funds managed by IIP. This risk is mitigated by

Operational risk

IIP places strong reliance on the operational procedures and controls that it has in place in order to mitigate risk and seeks to ensure that all members of staff are aware of their responsibilities in this respect.

The Firm has identified a number of key operational risks to manage. These relate to systems failure, failure of a third-party provider, key man risk and potential for serious regulatory breaches. Appropriate polices are in place to mitigate against these risks, which includes taking out adequate professional indemnity insurance.

Market risk

The Firm takes no market risk other than foreign exchange risk in respect of its accounts receivable and cash balances held in currencies other than GBP.

Since IIP takes no trading book positions on its balance sheet the Firm’s foreign exchange risk therefore would only arise in respect of its accounts receivable and cash balances held in currencies other than GBP.

No specific strategies are adopted in order to mitigate the risk of currency fluctuations.

Professional liability risk

The Firm has a legal responsibility for risks in relation to investors, products and business practices including, but not limited to; loss of documents evidencing title of assets of Infinity Ventures I fund (the“AIF”); misrepresentations and misleading statements made to the AIF or its investors; acts, errors or omissions; failure by the senior management to establish, implement and maintain appropriate procedures to prevent dishonest, fraudulent or malicious acts; improper valuation of assets and calculation of unit/share prices; and risks in relation to business disruption, system failures, process management. IIP is aware of, and monitors, a wide range of risks within its business operations and towards its investors. The Firm has in place appropriate internal operational risk policies and procedures to monitor and detect these risks. These procedures and risks are documented, demonstrating how the Firm aims to mitigate these risks. This is reviewed annually.

The Firm has in place appropriate coverage of professional indemnity insurance, where single claims are covered for up to £5m. The excess of £50k is held in Own Funds.

Regulatory capital

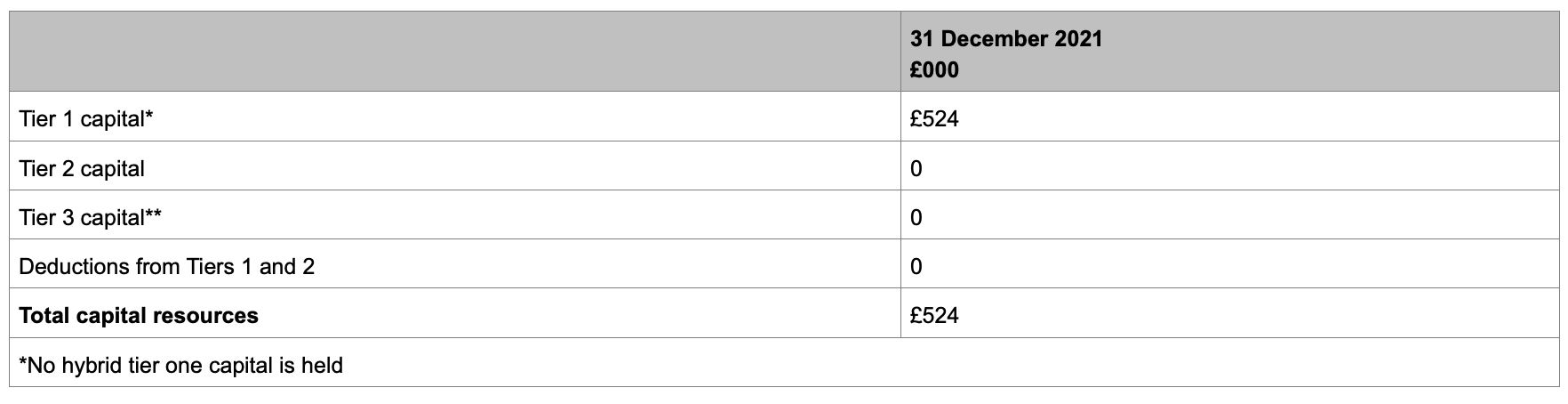

The Firm is a Limited Liability Company. Its capital is summarised as follows:

The main features of IIP’s capital resources for regulatory purposes are as follows:

The Firm is small with a simple operational infrastructure. Its market risk is limited to foreign exchange risk on its accounts receivable in foreign currency, and credit risk from management and performance fees receivable from the funds under its management. IIP follows the standardised approach to market risk and the simplified standard approach to credit risk.

BIPRU - The Firm is subject to the Fixed Overhead Requirement and is not required to calculate an operational risk capital charge though it considers this as part of its process to identify the level of risk based capital required.

As discussed above, IIP is a CPMI firm and as such, its capital requirements are the higher of:

- €125,000 + 0.02% of AIF AUM > €250m; and

- The sum of the market & credit risk requirements; or

- The fixed overheads requirement (“FOR”) which is essentially 25% of the Firm’s operating expenses less certain variable costs.

For a CPMI Firm

0.02% is taken on the absolute value of all assets of all funds managed by IIP (for which it is the appointed AIFM in excess of €250m, including assets acquired through the use of leverage, whereby derivative instruments shall be valued at their market value, including funds where the Firm has delegated the management function but excluding funds that it is managing as a delegate. The FOR is calculated, in accordance with FCA rules, based on the Firm’s previous years audited expenditure. IIP has adopted the simplified approach to credit and market risk and the above figures have been produced on that basis. The Firm is not subject to an operational risk requirement.

It is IIP’s experience that the Fixed Overhead Requirement establishes its capital requirements.

IIP’s Pillar 1 capital requirement has been determined by reference to the Firm’s Fixed Overheads Requirement (“FOR”) and calculated in accordance with Article 95 and the EBA regulatory technical standards (as applied by the FCA) as referenced in IPRU(INV) 11.3.3A / base €125k plus 0.02% of AIF AUM. The requirement is based on the FOR since this exceeds the total of the credit and market risk capital requirements it faces and also exceeds its base capital requirement of €50,000.

The FOR is based on annual expenses net of variable costs deducted. The Firm monitors its expenditure on a monthly basis and takes into account any material fluctuations in order to determine whether the FOR remains appropriate to the size and nature of the business or whether any adjustment needs to be made intra-year. This is regularly monitored and reported to senior management.

Remuneration Disclsoure

IIP is authorised and regulated by the Financial Conduct Authority as a Collective Portfolio Management Investment (‘CPMI’) Firm and, so, it is subject to FCA Rules on remuneration. These are contained in the FCA's Remuneration Codes located in the SYSC Sourcebook of the FCA’s Handbook.

CPMI Firms are required to make a remuneration disclosure in respect of the whole of their business, I.e. MIFID and AIFMD. The specific requirements of the AIFMD remuneration disclosure are set out in the Annual Report of the AIF(s).

The Remuneration Code (‘the RemCode’) cover an individual’s total remuneration, fixed and variable. The Firm incentivises staff through a combination of the two.

The Firm's business is to provide portfolio management services to its clients and to act as a manager of alternative investment funds.

- Are consistent with and promotes sound and effective risk management;

- Do not encourage excessive risk taking/risk-taking which is inconsistent with the risk profiles or instruments of incorporation of the AIFs they manage or sub-manage;

- Include measures to avoid conflicts of interest

- Are in line with the Firm's business strategy, objectives, values and long-term interests.

IIP’s policy is designed to ensure that it complies with the RemCode and its compensation arrangements:

Proportionality

Enshrined in the European remuneration provisions, as onshored into UK law by virtue of the EUWA, is the principle of proportionality. The FCA has sought to apply proportionality in the first instance by instituting two tests. Firstly, a firm that is significant in terms of its size must disclose quantitative information referred to in BIPRU 11.5.18R at the level of senior personnel. Secondly, a firm must make a disclosure that is appropriate to the size, internal organisation and the nature, scope and complexity of its activities.

IIP is not ‘significant’ (that is to say has relevant total assets <£50bn*) and so makes this disclosure in accordance with the second test (BIPRU 11.5.20R(2)).

* average total assets on the last three accounting dates.

Application of the requirements

The Firm is required to disclose certain information on at least an annual basis regarding its Remuneration Policy and practices for those staff whose professional activities have a material impact on the risk profile of the Firm. IIP’s disclosure is made in accordance with its size, internal organisation and the nature, scope and complexity of its activities.

- IIP’s policy has been agreed by the Senior Management in line with the Remuneration principles laid down by the FCA.

- Due to the size, nature and complexity of the Firm, IIP is not required to appoint an independent remuneration committee.

- The Firm’s policy will be reviewed as part of its annual process and procedures, or following a significant change to the business requiring an update to its internal capital adequacy assessment.

- IIP’s ability to pay bonus is based on the performance of the Firm overall and derived after its fund’s managed returns have been calculated by appointed third-party administrators.

1. Summary of information on the decision-making process used for determining the Firm’s Remuneration Policy.

-

Individuals are rewarded based on their contribution to the overall strategy of the business.

- Investment Generation

- Investment Trading

- Sales & Marketing

- Operations.

- Other factors such as performance, reliability, the effectiveness of controls, business development and contribution to the business are taken into account when assessing the performance of the senior staff responsible for the infrastructure of the Firm.

2. Summary of how the Firm links between pay and performance.

The Firm may omit required disclosures where it believes that the information could be regarded as prejudicial to the UK or other national transposition of Directive 95/46/EC of the European Parliament and of the Council of 24 October 1995 on the protection of individuals with regard to the processing of personal data and on the free movement of such data, as onshored into UK law by virtue of the EUWA.